Mabilung Energy's IPO Opening From Bhadra 22

Kathmandu, 15 Bhadra. Mabilung Energy Limited is going to open IPO applications from Bhadra 22 for local residents affected by the project and Nepalis working abroad. In the first phase, the company is preparing to issue a total of 5,36,295 shares.

How Many Shares for Which Group?

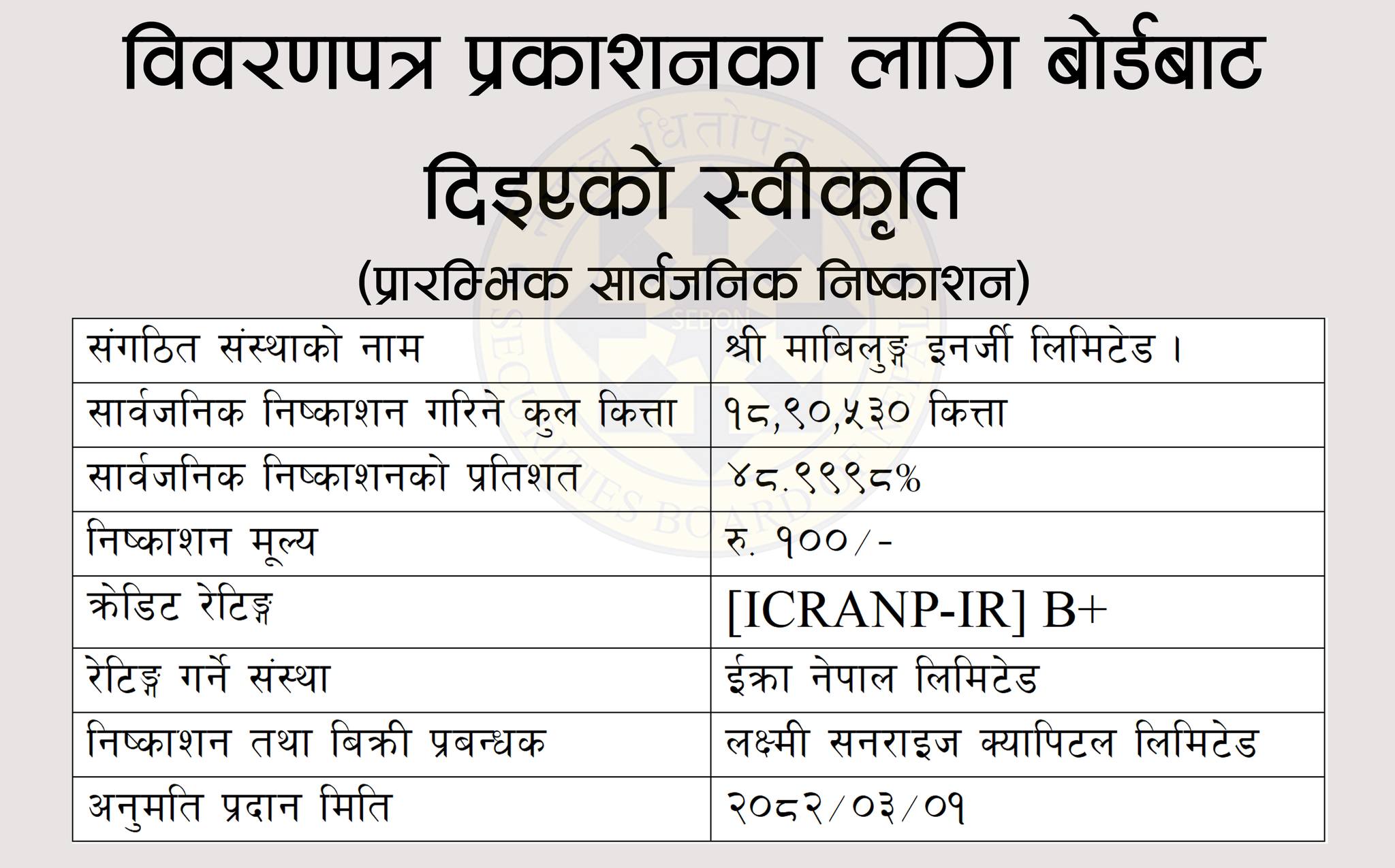

So far, the company has received permission from the Securities Board of Nepal to issue 1,890,530 ordinary shares, which is equal to 48.9998 percent of the issued capital.

In the first phase:

-

3,85,824 shares are reserved for local residents affected by the project.

-

1,50,471 shares will be for Nepalis working abroad.

Application Deadline and Process

- Local residents can apply until Shrawan 4. However, if all shares are not sold during that period, the deadline will be extended at least until Shrawan 19.

- Nepalis working abroad must apply by Shrawan 4.

How and Where to Apply?

Application Centers for Local Residents:

-

Global IME Bank, Chainpur Branch

-

Himalayan Bank, Madi Municipality Branch

-

Laxmi Sunrise Bank, Khandabari Branch

-

Project Site (Madi Municipality–7, Sankhuwasabha)

The application form fee is set at 2 rupees.

For Nepalis abroad:

-

All C-Asba Registered Banks and Financial Institutions approved by the Securities Board, and their branches

-

Can apply online via Mero Share Portal.

The minimum application for both groups is 10 shares and the maximum is 50,000 shares.

Mabilung Energy Limited is constructing the Upper Piluwakhola-3 Hydropower Project in Sankhuwasabha district with a capacity of 4.95 megawatts. The estimated cost of the project is 1 Arba 13 Crore 60 Lakhs rupees. The cost per megawatt is 22.95 Crore rupees with a total investment payback ordinary period of 9.43 years and a discounted payback period of 17.09 years. The permit period for necessary electricity production for the project operation still has 31 years remaining.

In the credit rating done for the IPO issuance, ICRA Nepal has assigned the company an ‘ICRA NP Issuer Rating B+’. This indicates that the company has average risk in terms of debt repayment capability.

The role of the selling and managing of this primary share issuance is being handled by Laxmi Sunrise Capital Limited.

Upcoming Phase for Public Offering

After the IPO issuance for the affected and foreign employment groups is completed, the company is preparing to issue 15,04,706 shares for the general public in the second phase. With this, the total issuance process will be completed.